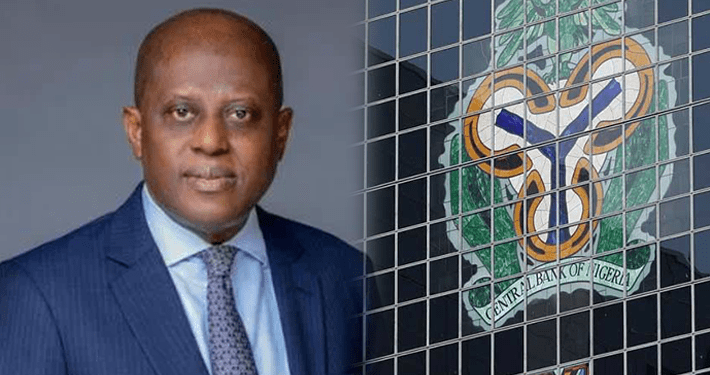

CBN Begins Process Of Blacklisting Bad Bank Borrowers

The Central Bank of Nigeria (CBN) is again in the process of blacklisting bad bank borrowers, making good the governor, Godwin Emefiele’s determination to go hard on habitual bank debtors and making it difficult for them to access credit anywhere in the system.

This was one of the key highlights of the Bankers’ Committee meeting on Tuesday in Abuja where Emefiele equally reminded bank executives of his zero tolerance stance on infractions, and his plans to intensify banking supervision.

Briefing on the outcome of the meeting which was also Emefiele’s first since assumption of office, Agnes Tokunmbo Martins, CBN director, banking supervision, passion for these two issues which he believed would help the nation’s financial stability.

Martins briefed alongside Ladi Balogun, managing director, FCMB; Phillip Oduoza, MD, UBA, and Segun Agbaje, MD GTBank. It would be recalled that the CBN in 2012 blacklisted a lot of serial bad borrowers whose debts ranged between N5 billion and above, most of which went bad and ended up in the books of the Asset Management Corporation of Nigeria (AMCON).

Speaking further on Emefile’s stance on the issue, Martins said the blacklisting of the debtors would be done gradually and that the CBN is now about to begin to blacklist those bad borrowers who owe below N5 billion. Her words, “We are working out the modalities, it is not something that is finished but it is something that I can assure you that will be concluded very very soon and the entire country will know those that are no longer entitled to borrow from banks because they have defaulted on some loans in the past.

We discussed extensively and also in line with the governor’s vision of financial system’s stability. The governor made it very clear that, that is one thing that he intends to pursue vigorously.

Supervision is going to be very very intense and one that he was very emphatic about is serial bad debtors.

For those debtors that go from one bank to another in different names and guises, taking money and not paying back, what the governor emphasised that is going to happen to them is that they will not be able to get credit anywhere in the system. They will be blacklisted.

"He emphasised that there is going to be zero tolerance for infractions, there is not going to be anything like soft touch regulation or supervision,” he stressed.

Martins also reiterated Emefiele’s passion to see a reduction in interest rates but that this would be done gradually.

“In addition, the governor is also passionate about the reduction of interest rates; however, it is something that would be done gradually. It is on his agenda that the CBN will achieve in collaboration with the industry,” Martins added.

Phillip Oduoza, who equally briefed the media, said another issue extensively discussed was the biometric capturing of bank customers which began on Monday as well as the cashless policy which is about to be rolled out nationwide by July, 1.

.jpg)